Turning Point

Teucrium | May 10, 2022

A Top for Grain Prices?

Jake Hanley, CMT, Managing Director / Sr. Portfolio Strategist

The GSCI Grains Index gained over 130% between August 7th 2020, and March 4th 2022. Front-month futures contracts for corn, wheat, and soybeans all traded near 10-year highs in April 2022. With prices pulling back over the past few sessions, some market participants are beginning to wonder if the "top is in."

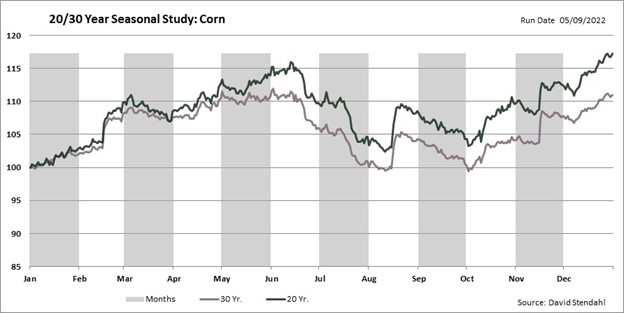

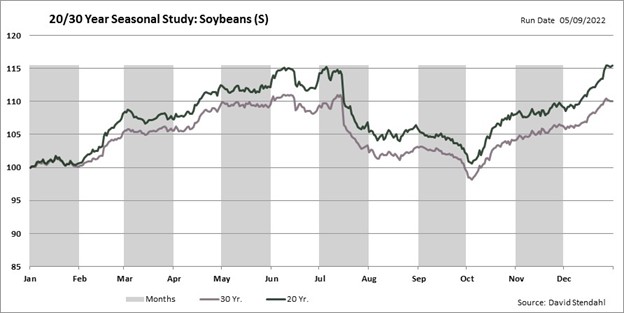

While it may be too early to call a "top," we do expect prices to face near-term headwinds. Historically, US corn and soybean prices peak in late Spring or early Summer (see charts below). Additionally, we are expecting a build in US inventories this year, weather permitting.That suggests that by this time next year, prices may be well on their way back toward the cost of production.

Base Case: Expanding Inventories

You may recall from our 2022 Grain Outlook that we were expecting inventories to build this year. High crop prices are a natural incentive for increased production. As such, we anticipated that farmers around the globe would look to plant as much as possible in 2022. The more acres planted, the greater the potential for increased production. Higher production suggests greater supplies and expanding inventories. Larger inventories are fundamentally bearish for prices. Yet, we also flagged two big risks in our 2022 Outlook, namely weather (La Nina) and a Russian invasion of Ukraine, both of which came to fruition. If not for adverse weather conditions and the war in Ukraine, grain prices would likely be lower than they are today.

Drought, War, and Hope

Farmers in Brazil, Argentina, and Paraguay planted a record amount of corn and soybean acres this year. Yet, a La Nina-driven drought hampered production. The poor weather hit soybean farmers the hardest.Latest estimates show final South American production down approximately 15% from original projections.

Production is not so much of an issue for wheat markets.Global inventories remain at reasonable levels. The issue is that much of the world’s wheat is trapped in the Black Sea region. Roughly 30% of global wheat exports were expected to come out of the Black Sea region this year. The Russian invasion of Ukraine has crippled supply chains; trade in and out of the Black Sea is all but non-existent at this point.

Given the South American production issues and the war in Ukraine, the world is hoping for a successful US crop. With combined corn and soybean plantings expected to come in near-record levels, we may see record US production, if the weather cooperates. That is a big "if."

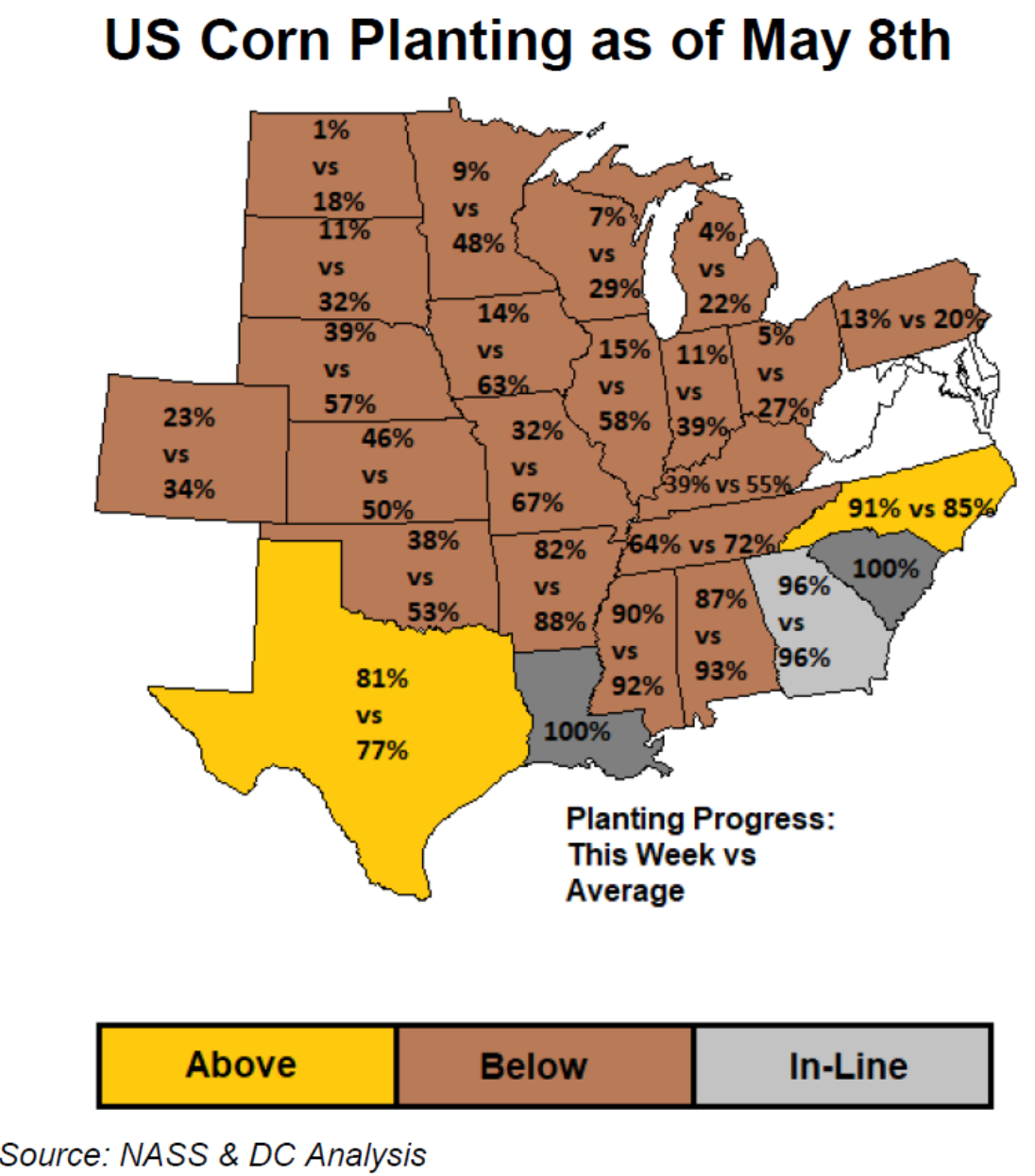

Poor weather is already creating issues and has led to planting delays over much of the corn belt. By this time last year, 64% of the expected corn crop had already been planted. As of this writing, that number stands at only 22%.

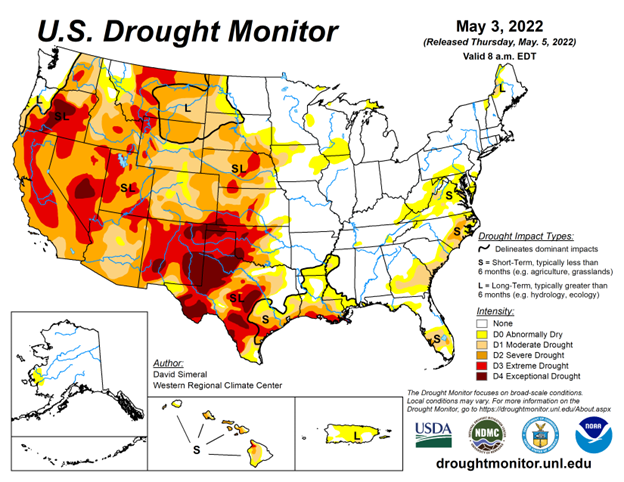

Getting the crop in the ground is the first step. Next, the trade will focus on weekly crop condition reports and weather forecasts. We’ll be keeping a close eye on the weekly drought monitor, which currently shows dry conditions over much of the western corn-growing areas. Yield expectations may take a hit if that dry area extends eastward.

At Some Point…

Supply/demand fundamentals continue to support higher grain prices. Yet, at some point, prices will return to trade near their cost of production. Bad weather and the war in Ukraine have only delayed the inevitable. Whether or not we have put in the top is anyone’s guess. If global weather cooperates and geopolitical tensions cool, we may look back and point to the ’22-’23 crop as the critical crop that helped stabilize world food prices.

Expect Volatility

Corn, wheat, soybean, and sugar markets are volatile. Prices may fall as quickly as they rise, if not more quickly. Options are available on the following funds: CORN, WEAT, SOYB, CANE, and TAGS. Please consult your broker for additional information.

Please read the prospectus carefully prior to investing.

Follow us on Twitter: @TeucriumETFs

LinkedIn: Teucrium ETFs

Subscribe to our Newsletter: www.teucrium.com